Just few years ago, fintech was a promising niche but today, it's growing at breakneck speed. Statista predicts the global fintech market will hit $190 billion by 2026, growing at a rapid 13.7% annually.

In this fast-paced market, technologies also evolve quick. The tech stack you think it's effective this year may not stay on top in the next years.

So, the burning question is: What does a future-ready fintech tech stack look like in 2025?

Through this article, we're going to break down the new, as well as old-but-gold technologies, that will power your financial apps, make your transactions smoother, and keep your data safer.

Let's dive in!

What is a fintech tech stack?

A tech stack is the complete set of technologies that power a software application.

For fintech companies, this means the collection of programming languages, frameworks, tools, and platforms that make their financial software run.

One thing to remember here: fintech apps aren't just ordinary apps. They handle people's money.

So, a fintech tech stack needs to be super secure, super fast, super reliable and ensures the software have:

- Blazing-fast transaction processing.

- Rock-solid data security.

- Ability to grow with the business.

- Compliance with strict financial regulations.

The importance of a modern fintech tech stack

The right technology stack isn't just a nice-to-have - it can make or break your fintech business.

Why does it matter so much?

There're so much chances for cyber attack: A bank vault is never wide open. You need ironclad security to protect your customers' money.

Nobody likes waiting: In the fast-paced world of fintech, slow is the new enemy. Your app needs to be lightning-fast, or you'll lose customers to the competition.

The market is so dynamic and fluctuating: The fintech market is always changing. A flexible tech stack lets you adapt to new trends and technologies without breaking a sweat.

UX is more than king: Fast, smooth, reliable. Your fintech software should work perfectly, every single time. A well-built tech stack is the foundation.

Most successful fintech companies understand that their technology infrastructure is a strategic asset. It's not about having the newest tools, but about having the right tools that can adapt, protect, and deliver value to customers.

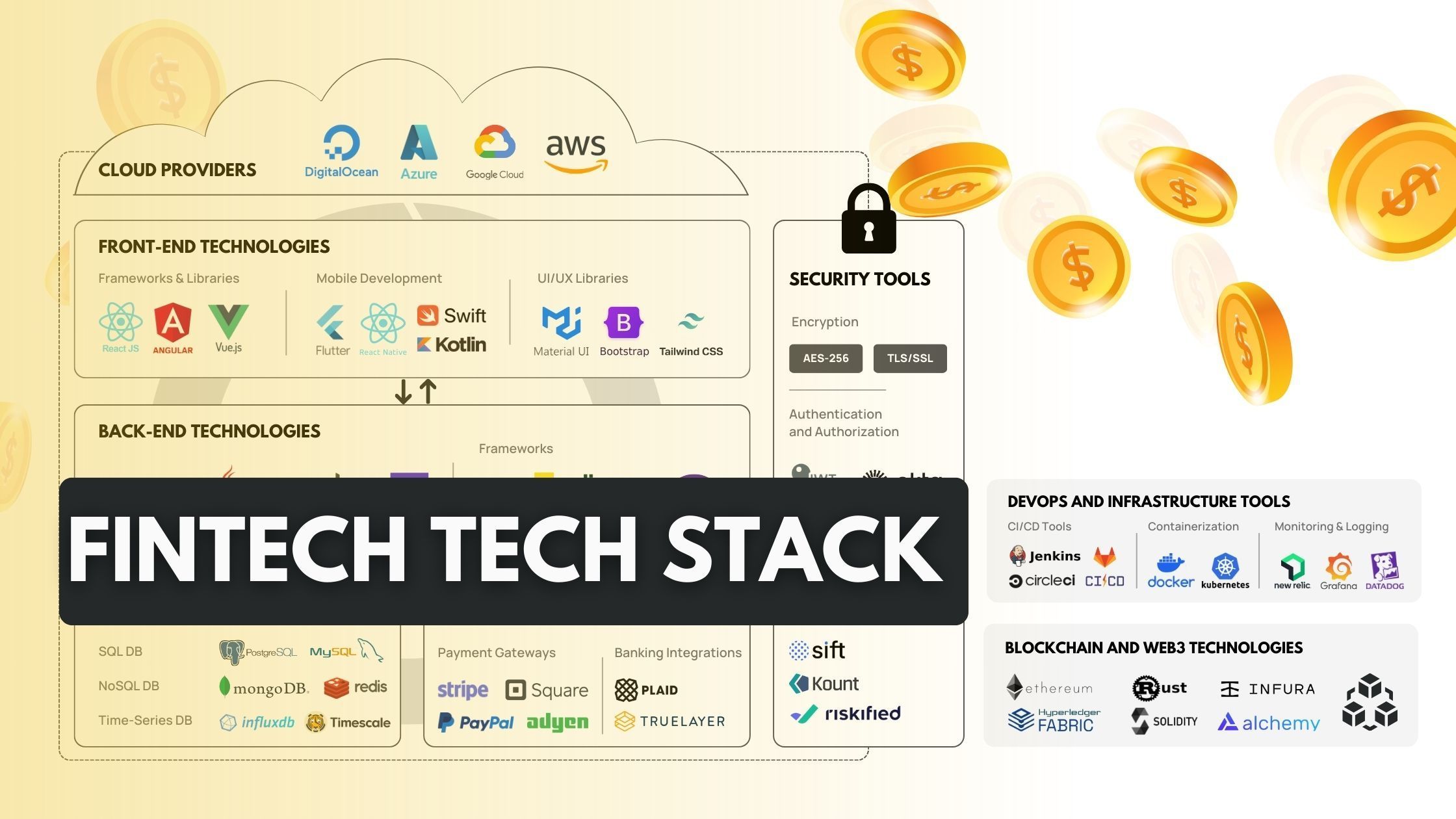

What a modern fintech tech stack look like in 2025?

The world of fintech is moving at breakneck speed. To stay ahead of the curve, you need a tech stack that's as dynamic as the industry itself.

So, what should a future-proof fintech tech stack look like?

Let's break it down.

Overview of fintech technology stack

| Category | Technologies | Key Strengths | Best Suited For |

|---|---|---|---|

Frontend | React.js | Scalable, component-based | Web applications with complex interactions |

Frontend | Angular | Robust security | Enterprise-level financial platforms |

Frontend | Flutter | Cross-platform development | Mobile apps with consistent performance |

Backend | Java Spring Boot | Enterprise-grade reliability | Complex financial systems |

Backend | Node.js | Fast, event-driven | Real-time financial applications |

Backend | .NET Core | Security and scalability | Large-scale fintech solutions |

Databases | PostgreSQL | Structured data reliability | Transactional financial records |

Databases | MySQL | Robust data management | Financial reporting and core banking |

Databases | MongoDB | Flexible data handling | Complex analytics and unstructured data |

Cloud Services | AWS | Comprehensive compliance | Regulatory-heavy financial applications |

Cloud Services | Azure | Global enterprise security | International financial operations |

Cloud Services | Google Cloud | AI integration | Innovative fintech startups |

Emerging Technologies | AI/ML | Advanced analytics | Fraud detection, personalization |

Emerging Technologies | Blockchain | Enhanced security | Transparent transactions, smart contracts |

Emerging Technologies | Low-Code Platforms | Rapid development | Quick prototyping and iteration |

Key considerations for a modern fintech tech stack

Building a future-proof fintech tech stack doesn't mean chasing the new technologies. It's about making strategic choices that address core business needs:

High scalability: Your tech stack must flex and grow seamlessly. As user bases expand and transaction volumes increase, your infrastructure should scale without breaking a sweat.

Solid security: Your stack needs robust encryption, advanced fraud detection, and ironclad data privacy tools that meet global regulatory standards.

Excellent performance: Real-time matters. Customers expect instant transactions, zero downtime, and millisecond-level response times. Your tech stack needs to deliver performance that feels almost magical.

Easy integration: Your stack should easily support APIs, open banking frameworks, and microservices architectures that enable smooth data exchange and innovative feature development.

Efficient cost: Innovation is important, but so is your bottom line. The best tech stacks balance high-quality tools with smart budget management, avoiding unnecessary complexity.

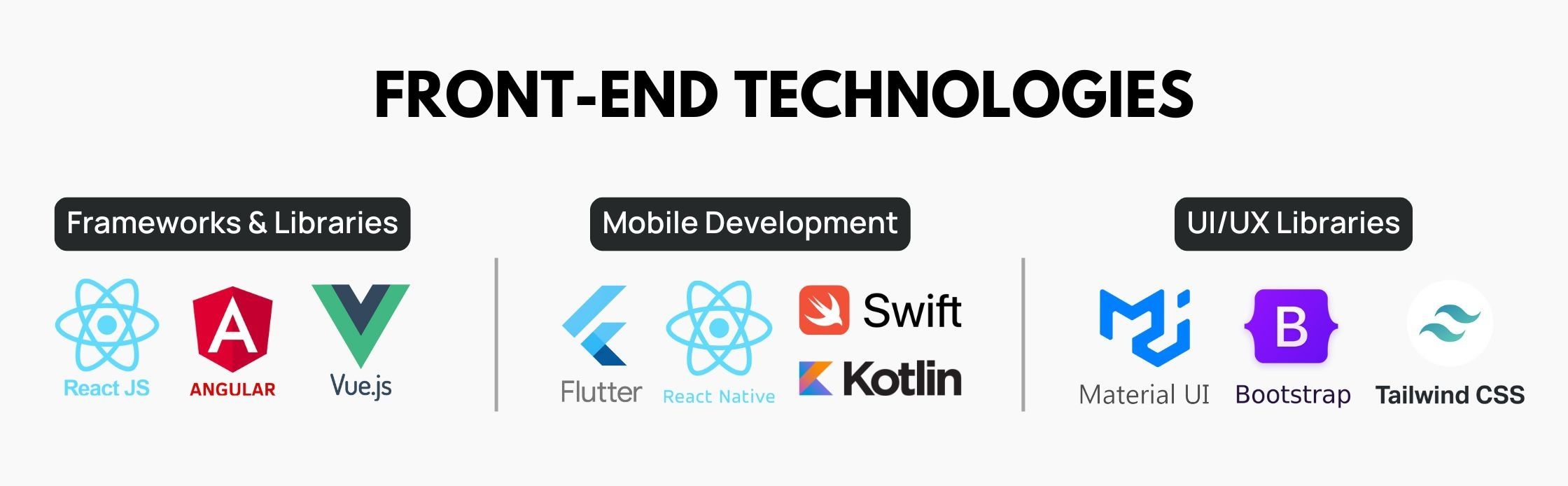

Frontend technologies for fintech apps

Modern fintech applications need more than just good looks - they need responsive, intuitive, and secure user interfaces that can handle complex financial interactions. The frontend technologies of 2025 are all about creating seamless, accessible, and performant user experiences.

React.js: It has become a popular choice for building dynamic and fast-loading user interfaces. Its component-based architecture makes it easier to create complex, interactive UIs.

Angular: For large-scale, enterprise-level fintech applications, Angular offers a comprehensive framework with strong security features and robust performance.

You can get to know more about hiring Angular developers here

- Flutter: It allows you to build beautiful, native-like apps for both iOS and Android using a single codebase. This reduces development time and ensures consistency across platforms.

Some of our tips on finding the good Flutter developers.

In 2025, there're some emerging trends in frontend development you need to know to stay ahead of the curve. Micro frontends can break down large applications into smaller, more manageable pieces, while progressive web apps (PWAs) are blurring the lines between web and mobile experiences.

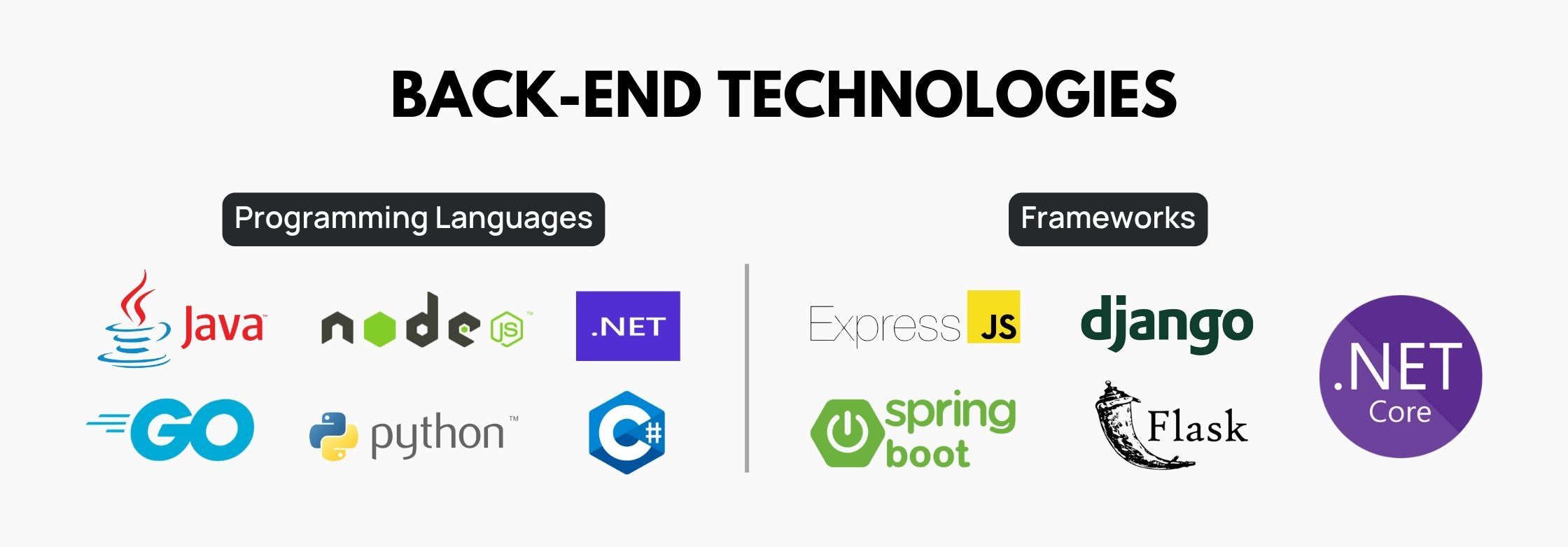

Technologies for fintech backend development

The backend is the engine room of a fintech application. It handles complex financial operations, ensures data security, and enables seamless user experiences. Here are some of the key technologies driving backend development in fintech:

Java Spring Boot: The gold standard for enterprise-grade backend development. Its robust ecosystem and strong security features make it ideal for complex financial systems that demand reliability. It's also the most popular technologies in the world so you can find Java talents easily. But you should do some research on skills, salary of Java developers to hire the right ones.

Node.js: Lightweight and incredibly fast, Node.js excels in non-blocking and event-driven architectures. It's perfect for handling high-traffic, data-intensive workloads.

.NET Core: Microsoft's framework offers exceptional security and scalability, making it a top choice for large fintech solutions that need to handle massive transaction volumes.

An emerging trend in backend development is serverless computing. Platforms like AWS Lambda and Azure Functions are changing the way backend applications are built and deployed. By eliminating the need to manage servers, you can focus on writing code and deploying it quickly.

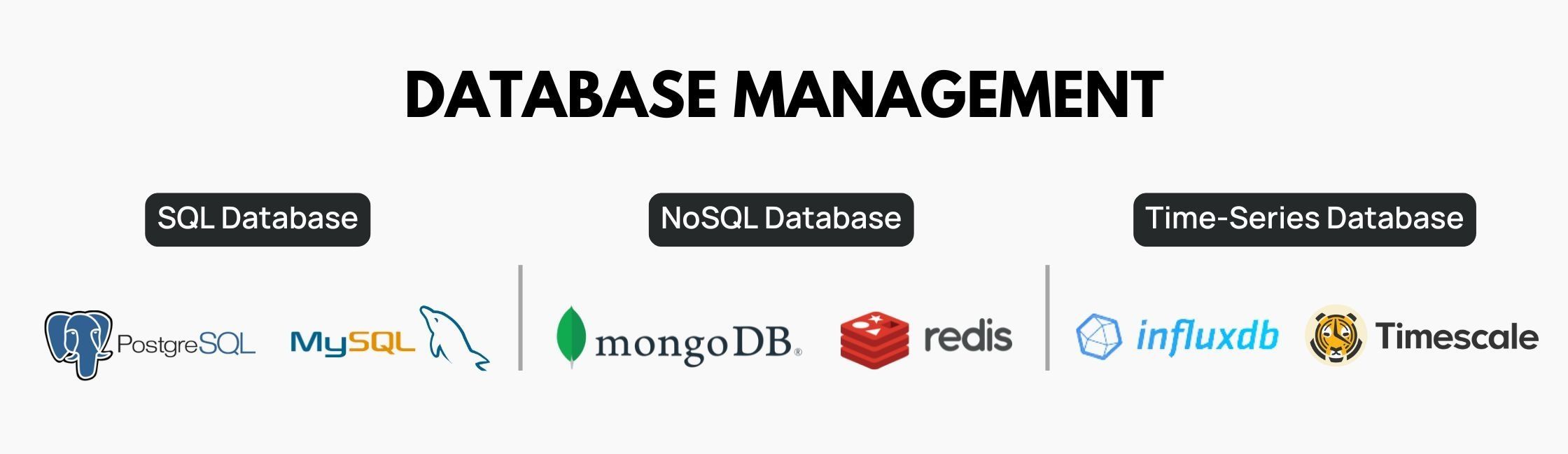

Fintech database technologies

Data is the lifeblood of any fintech application. To ensure data integrity, security, and performance, it's crucial to choose the right database technology.

SQL Databases like PostgreSQL and MySQL, are the traditional choice for structured financial data. They provide rock-solid reliability for transactional data, customer information, and financial reports.

NoSQL Databases, such as MongoDB and Cassandra, are designed to handle large volumes of unstructured or semi-structured data. They are well-suited for storing real-time data, user preferences, and analytics data.

In 2025, many fintech companies are adopting hybrid solutions, combining SQL databases for core transactional data with NoSQL systems for advanced analytics and real-time insights.

Cloud services for fintech apps

Cloud technology has transformed how fintech companies build and scale their applications. Some major cloud providers for fintech include:

AWS (Amazon Web Services): Offers unparalleled scalability and comprehensive compliance tools, making it a top choice for fintech companies with complex regulatory requirements.

Azure (Microsoft Azure): Provides enterprise-grade security and a global infrastructure that supports international financial operations.

Google Cloud: Stands out with its AI integration and cost-effective solutions, particularly attractive for innovative fintech startups.

The trend is moving towards multi-cloud strategies, allowing companies to reduce dependency and enhance overall system flexibility.

Emerging technologies shaping the fintech tech stack

The future of fintech is being written by transformative technologies that are reshaping how we think about financial services:

AI and Machine Learning: These technologies are transforming the fintech industry by enabling advanced analytics, fraud detection, and personalized financial advice.

Blockchain: Beyond cryptocurrencies, blockchain is enhancing transparency and security in payments, lending, and contract management.

Real-Time Data Streaming: Technologies like Apache Kafka enable efficient data streaming and processing.

Low-Code/No-Code Platforms: These are accelerating product delivery, allowing fintech companies to build apps and go to market faster.

Fintech tech stack for each type of fintech applications

Each fintech domain has unique technological requirements that demand specialized approaches. Let's break down the ideal tech stack for different fintech solutions.

1. Payment apps

Payment applications are the digital highways of financial transactions. They require lightning-fast performance, rock-solid security, and seamless user experience.

Recommended Tech Stack:

- Frontend: React.js, Flutter (for cross-platform development).

- Backend: Node.js, Java Spring Boot.

- Databases: PostgreSQL for transactional data, Redis for caching.

- Payment APIs: Stripe, PayPal, Braintree for transaction processing.

- Security Tools: OAuth for authentication, TLS/SSL encryption.

📌 Key Focus

Ultra-fast transaction processing, multi-layer security, and smooth user interfaces.

2. Lending platforms

Lending platforms combine complex financial algorithms with user-friendly interfaces, requiring robust backend capabilities and advanced risk assessment tools.

Recommended Tech Stack:

- Frontend: Angular, React.

- Backend: .NET Core, Python Django.

- Databases: MySQL for structured data, MongoDB for flexible data storage.

- AI Tools: Machine learning models for credit scoring and risk assessment.

- Financial APIs: Plaid, TrueLayer for financial data integration.

📌 Key Focus

Advanced risk modeling, comprehensive financial data analysis, secure data handling.

3. Wealth management and investment platforms

These platforms demand real-time data processing, advanced analytics, and intuitive visualization of complex financial information.

Recommended Tech Stack:

- Frontend: Vue.js, Flutter.

- Backend: Go, Java Spring Boot.

- Databases: Cassandra for high-performance data storage, Elasticsearch for advanced search and analytics.

- Market Data APIs: Alpaca, IEX Cloud for real-time market information.

- Emerging Tools: AI-powered portfolio management and recommendation systems.

📌 Key Focus

Real-time market data processing, personalized investment insights, scalable architecture.

4. Blockchain and Decentralized Finance (DeFi)

DeFi represents the cutting edge of financial technology, requiring specialized frameworks and a fundamentally different approach to financial systems.

Recommended Tech Stack

- Blockchain Frameworks: Ethereum, Hyperledger.

- Smart Contract Language: Solidity.

- Backend: Python for blockchain interactions.

- Storage: IPFS for decentralized data storage.

- Development Tools: Web3.js, Truffle Suite for blockchain integration.

📌 Key Focus

Transparency, decentralization, smart contract security, and innovative financial models.

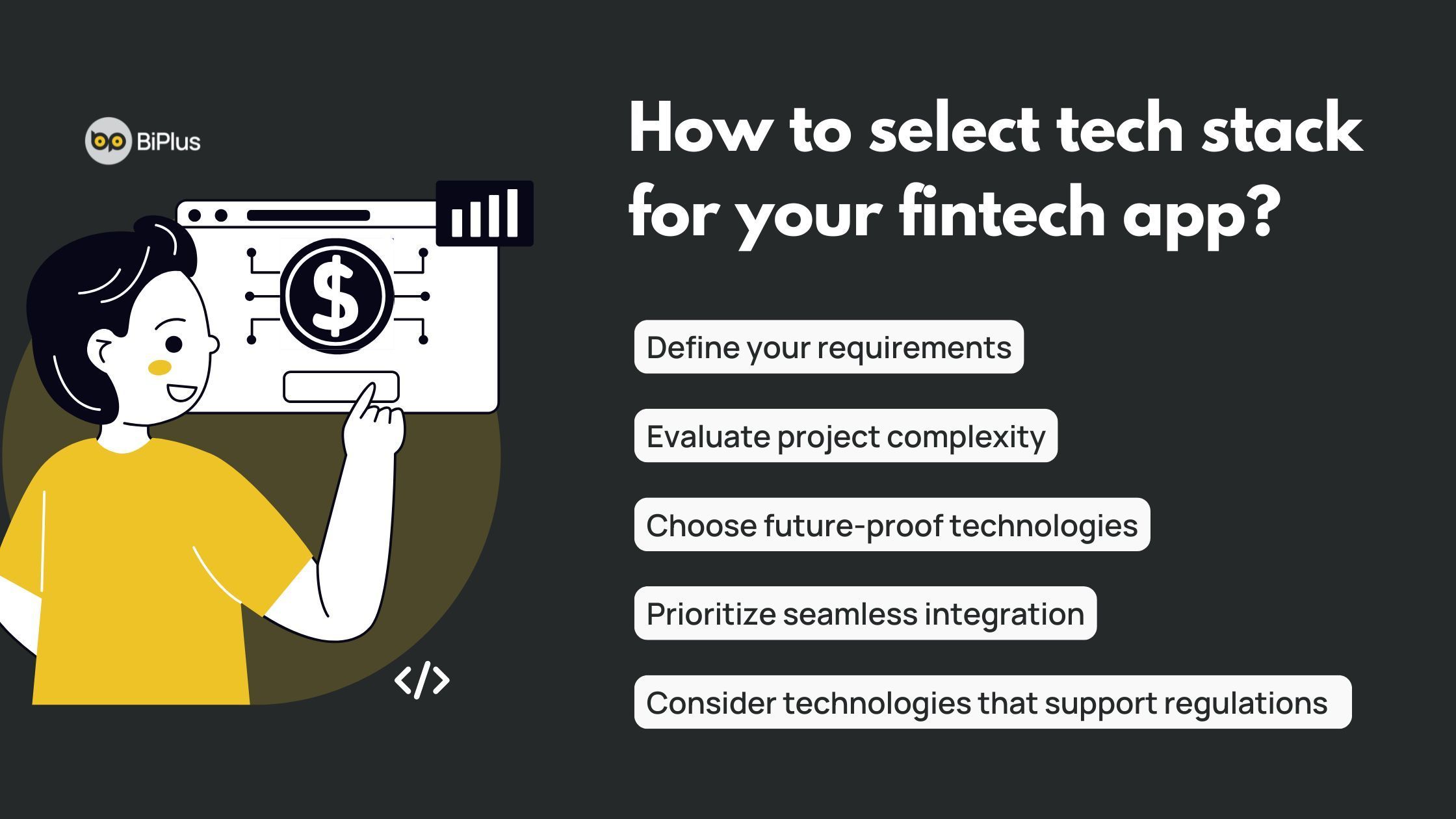

How to decide on a tech stack for your fintech solution

Drawing from our years of experience working with global fintech clients, we've developed a practical approach to tech stack selection.

Define your requirements

Before diving into technology, it's essential to have a clear understanding of your project's requirements.

Answer these:

- Can your system handle growth and increased user loads?

- How will you protect sensitive financial data?

- Will your app be fast and responsive?

- What kind of user interface and experience do you want to provide?

- Will your tech stack adhere to relevant regulations?

A payment app for a local credit union will have very different technological needs compared to a global investment platform. Your tech stack should be a tailored suit.

Evaluate project complexity

Your technology choices should match your project's complexity:

For simple applications: Lightweight stacks like React or Angular for the frontend and Node.js or Python for the backend, can be perfect for straightforward solutions.

For complex systems: Enterprise-grade technologies like Java, Kubernetes, and advanced microservices architectures become necessary for more sophisticated platforms.

Compliance is non-negotiable

Your tech stack must:

- Support financial regulations like PCI DSS, GDPR.

- Enable robust security protocols.

- Provide comprehensive audit trails.

- Facilitate easy reporting and monitoring.

Choose future-proof technologies

The financial technology landscape evolves rapidly. Your tech stack should be:

- Adaptable to emerging technologies.

- Supportive of microservices architecture.

- Compatible with serverless computing.

- Ready for modern API integrations.

- Open to AI and machine learning implementations.

Prioritize seamless integration

Look for technologies that:

- Offer robust API support.

- Enable easy third-party service connections.

- Provide flexible data exchange mechanisms.

- Support multiple integration patterns.

Meet BiPlus: Your fintech app development partner

Our developers excel in Java, Python, PHP and Node.js, enabling us to build comprehensive backend systems.

For mobile development, we leverage Kotlin for Android, Swift for iOS, Flutter for cross-platform development ensuring performance and seamless user experiences.

In our recent project with a fintech company, we helped them achieve 3x feature release in one year and a 20% revenue increase in payment services.

You can read our full story here.

Our fintech app development services include:

- Mobile app development

- Back-end development

- User experience (UX) and User interface (UI) design

- Application and network security

- Cloud computing

- Payment processing APIs

- Artificial intelligence and machine learning integration

- Blockchain implementation

Contact Us to discuss your fintech app development, we'd love to meet you.